One sure way to slow down time is to stick to a strict budget each month.

Chad and I have been cracking down on our Family Budget lately and I can’t believe it is still February. Can March come already?

We have been morphing together this bills binder and this budget binder into a system that will work for our family. Hopefully, one that is simple and manageable. We’ve got our binders, tabs, pockets, and spreadsheets and now we are just tweaking and modifying as we work through the bugs in real life.

We have gone to the cash envelope system for a few budget line items. I know Dave Ramsey supports going all cash, but I just can’t bear to get out of my car and pay for my gas before I have pumped it. One day I might bring big bills to Costco but for now we still use our debit card for gas and groceries.

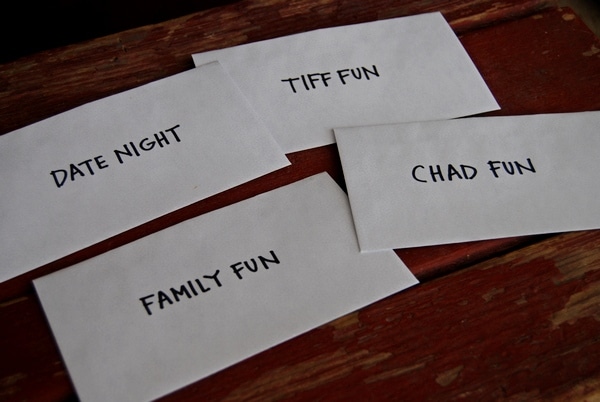

You gotta know by now I am a baby steps girl, so for now Chad and I just picked 4 areas where we could go ‘cash only’ to get comfortable with the concept. We made cash envelopes for Family Fun, Tiffany Fun, Chad Fun, and Date Night. These are all areas that are easy to overspend in, so cash helps keep us in check.

There are some really cute cash envelope wallets out there, but I just used an old binder pouch for my cash envelope system that I had around. The main pocket holds the cash envelopes just perfectly. I keep the Family Fun, Date Night, and Tiffany Fun envelopes in the binder pouch and Chad keeps track of his fun money.

My favorite part of the binder pouch is that it had a small pocket on the front that could double as my coin purse. I didn’t want to try to put coins back in the envelopes. I wasn’t going to be that strict so all my change goes into the coin pocket and I can use it for whatever.

At the beginning of each month, I fill these envelopes with the allotted amount for the month and then I spend from these envelopes. This system is also a great way to store gift cards (and maybe even coupons?) All my birthday gift cards went right into my Tiffany Fun envelope.

The cash envelopes are really keeping us in check. Last Saturday night, Chad and I went out on a date and we only had $20 left in our Date Night budget so we picked a cheap restaurant, shared a meal and hit the grocery store afterwards for our hot date. The night before the Family Fun budget only had $10 left and Chad and the girls had a Daddy Daughter night planned. They knew the budget was low so they opted to get frozen yogurt at a place where they had a coupon Their date only cost $2.17.

But as gung ho as Chad and I are about our Family Budget, we knew we needed to teach our children to help them understand and to be a part of the budget process.

My goal was to increase my children’s financial awareness, but to NOT stress them out.

I didn’t want them to think that we were going to be homeless or that they would never see Disneyland again, but I did want them to understand dance, piano, basketball, ice cream cones, pizza, and lights all cost money.

So I came up a with a Family Budget Family Night:

Attention Getter: I read this quote from Robert D. Hales.

“Another important way we help our children learn to be provident providers is by establishing a family budget. We should regularly review our family income, savings, and spending plan in family council meetings. This will teach our children to recognize the difference between wants and needs and to plan ahead for meaningful use of family resources.” You can read his full talk here.

Objective: I told my children that tonight we were going to look at our family budget and our spending plan so that we can all see where our money goes each month.

Lesson: I showed them $100 worth of pretend money. I told them let’s pretend this is the amount of money that dad brings home each month.

(You could do any amount, but I would keep it in an even, round number like 10 or 100 or 1000 because we are going to be working in percentages. Make sure to have a variety of bills so the $100 can break down easily. And also remember this is not literal but rather a representation of a family budget.)

We talked about some of our needs first — what we needed to pay for and what we really needed to have. As the kids said some of our needs, I would take away money from the original $100.

Here are some of our expenses and the amount of money we subtracted:

Tithing $10 (We donate 10% of what we earn to The Church of Jesus Christ of Latter-day Saints)

Savings $20

Taxes $10

Rent $20

Food & Household Supplies $10

Insurance (Health, Life, Car, Home, etc.) $10

Utilities $5 (we explained what these were)

Car & Gas $5

That means we had $9 left over for our wants. We discussed what some of those wants were such as Christmas, entertainment, clothes, haircuts, birthdays, extra curricular activities, etc. The kids saw quickly that life costs more than we think and that there is not a lot left over for all the fun stuff.

We talked about how if we want to have more money for our wants than we need to cut back on some of our needs. So we discussed ways the kids could help us save money. We wrote our list on a giant post-it note easel pad. Here is what we came up with:

Ways Kids Can Help Save Money?

Don’t waste (food, paper, toothpaste, toilet paper, etc.)

Turn off lights, computers, TV, Wii, piano (We reviewed our Check Your Zone! strategy)

Don’t crank up the heat when you are cold; put a jacket on

Don’t turn up the air conditioning when you are hot; go downstairs

Take care of clothes and toys and other belongings

Eat out less

Don’t put clothes in laundry unless dirty

Make a home lunch

Walk, ride bikes or carpool

Don’t leave water running

Earn own money

Close doors when you go outside

Be okay with less

I felt like it was a successful Family Night. We made a helpful list and the kids were really seeing where the money goes and how they could help.

We still have a long way to go on our Family Budget, but I see so much progress. The kids are asking to eat out less. They are suggesting coupons and ways to spend less. They are a part of the Family Fun budget and how we spend it. And we got our utility bill for last month and it was $20 less than the month before the budgeting lesson. I like to think it was because they were so good at turning off the lights.

T-minus 2 days until March 🙂

![I spoke in church today and said the Atonement of Jesus Christ is the greatest act of Charity. I read Moroni 7:45-47 to make my point. But wherever there was the word ‘Charity’ I substituted it out for ‘the Atonement of Jesus Christ.’ See if these scripture verses now have new meaning for you:

“And the Atonement of Jesus Christ suffererth long, and is kind, and envieth not, and is not puffed up, seeketh not her own, is not easily provoked, thinketh no evil, and rejoiceth in the truth,

[The Atonement of Jesus Christ] beareth all things, believeth all things, hopeth all things, endureth all things.

Wherefore, my beloved brethren, if ye have not the Atonement of Jesus Christ, ye are nothing, for the Atonement of Jesus Christ never faileth. Wherefore, cleave unto the Atonement of Jesus Christ, which is the greatest of all, for all things must fail-

But the Atonement of Jesus Christ is the pure love of Christ, and it endureth forever; and whoso is found possessed of it at the last day, it shall be well with him.”

So Easter really reminds us of love. The first and greatest commandment.](https://www.raisinglemons.com/wp-content/plugins/instagram-feed-pro/img/placeholder.png)

Great ideas! I would like to try the cash method one day! Have you and Chad ever checked out https://www.mint.com/? Nate and I use it and love it!

This is awesome. Just wondering if you guys budget the same for each month or take into account the length of the month? For instance march will have more date nights than February. Great post tiff!

No, Laura, each month is the same. I figure it all works out because although February might be shorter it has Valentine’s day in where we typically spend a little more money.

I love Dave Ramsey too but I am like you and refuse to pay cash for gas! Pay at the pump is the only way to go with small kids.